13.11.2024

Spendido - Intrum's initative to help reduce over-indebtness

Through our financial education initative 'Spendido', Intrum reaffirms its commitment to building a financially secure and sustainable future for all.

At Intrum, our purpose is to lead the way to a sound economy. As well as helping our clients by caring for their customers, we aim to use our knowledge of credit and collections to help society in a wider sense.

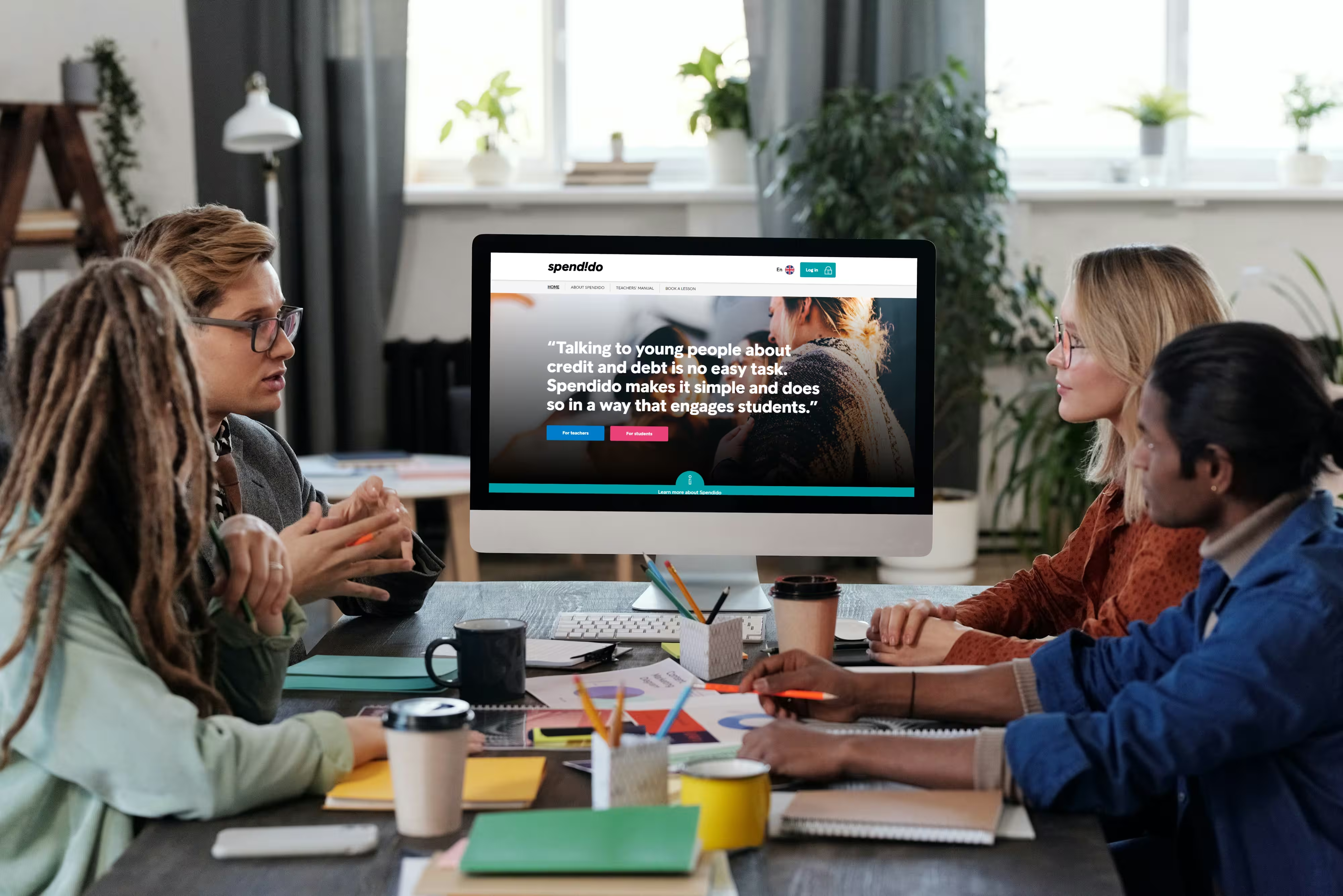

Spendido is an initiative that Intrum has devised to help reduce over-indebtedness. A free, interactive online lesson for secondary school students, it teaches young people about credit, debt and the consequences of not paying on time.

Financial wellbeing across borders

This project, which started in Sweden and is also used in Germany and Austria, is the result of requests from teachers for assistance in teaching personal finance. In addition, Intrum’s annual European Consumer Payment Report shows year by year that consumers lack understanding of financial concepts.

Poor financial literacy has a knock-on effect on wellbeing, as those who lack sufficient financial education worry more about the effects of interest rate rises and inflation than those who understand the way the system works.

The long-terms effects of poor financial management can also be severe, with young people unable to take out a mobile phone contract, secure a mortgage or, in some cases, pursue the career of their choice.

Helping society function

By equipping young people to manage their finances effectively, we can help reduce over-indebtedness, setting students on the path to a healthy financial future; benefiting businesses by making it more likely they are paid on time; and helping society function smoothly.

Spendido covers important aspects of financial education, including:

Until now I've struggled to find a simple way to explain concepts like effective interest and personal finance in a straightforward way. For people of this age, interest and money are unfortunately often quite abstract concepts, because it's mum and dad who pay. But [Spendido] explains interest in a way that quickly becomes very concrete for the studentsTeacher in Sweden

Building on expertise

As an expert in credit and debt collection, Intrum is ideally placed to offer a solution to the issue of financial literacy. We speak to over 250,000 people a day about their finances, helping them resolve debt problems and set up payment arrangements.

Educating young people on credit and debt will help many avoid falling into difficulty, while ensuring they know how to handle financial problems if they occur.

Spendido is a practical and accessible tool for both teachers and students. A free resource, it meets national curriculum standards and can be adapted and extended to suit individual needs.