These are the bills that European consumers prioritise

Though many Europeans pay their invoices before they are due, some find it difficult to keep up with financial commitments. Our insights tell us that when in financial strain, consumers prioritise certain bills first.

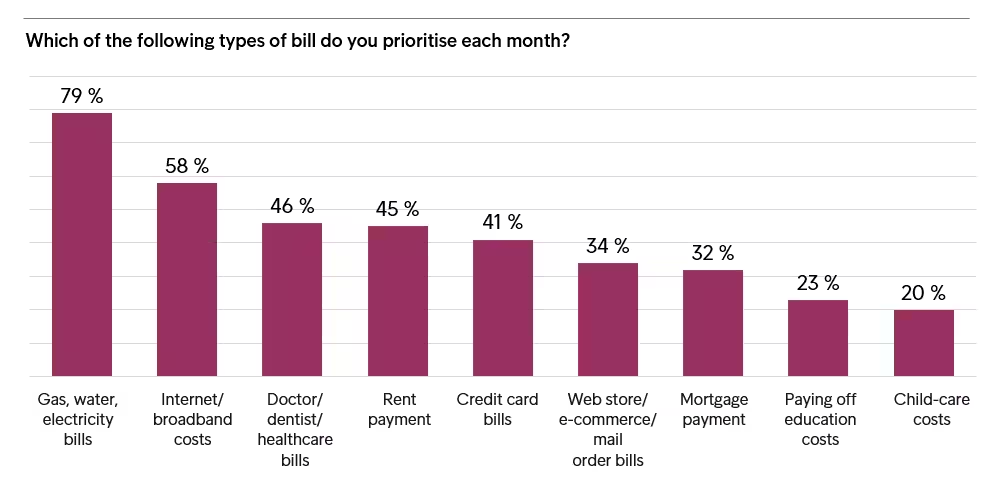

The latest European Consumer Payment Report 2019 from Intrum finds that for European consumers of all ages and backgrounds, gas, water and electricity bills are their number one priority.

The ‘big three’ bills come first

On average, eight out of ten (79%) of European consumers who responded to Intrum’s survey say that they prioritise paying their living expenses first: gas water and electricity bills. That’s well ahead of any other bill, with rent and mortgage payments ranking at just 45% and 32% respectively (the latter also comes further down the list than web/mail-order payments, which rank at 34%).

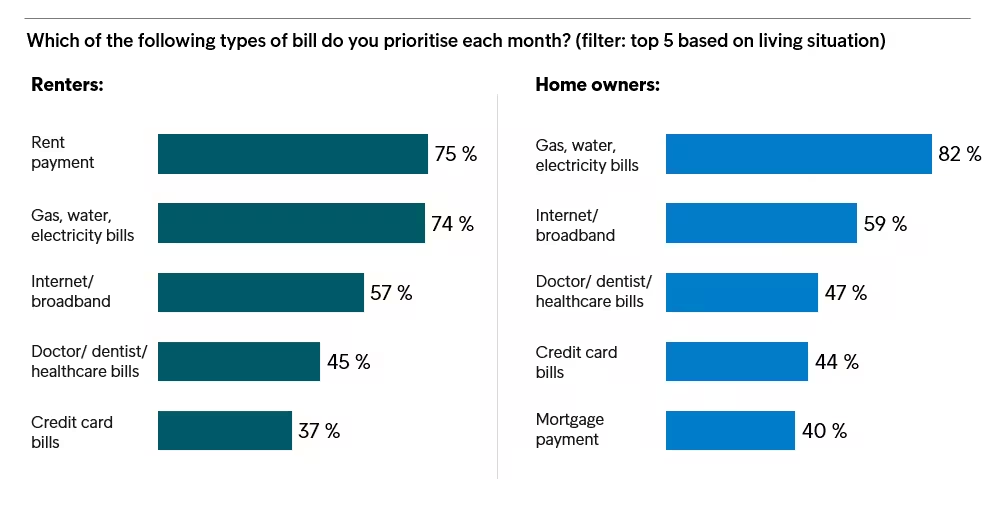

How people prioritise their bills naturally depends on their individual living situation. Among European consumers that rent their home, the top prioritised are rent payment (75%) and gas, water and electricity (74%). In contrast, consumers that own their home say that they prioiritise gas, water and electricity bills (82%) and internet/broadband costs (59%).

And the picture is the same whether one is looking at any of the 24 countries which took part in the report survey.

By country, the average figure for prioritising gas, water and electricity bills ranges from 70% (Norway) to 89% (Hungary). By age group, even 60% of 18 to 21-year-olds -- who can often be still living at home and can often be regarded as perhaps being a bit more carefree than those who are older -- say that gas, water and electricity bills come first. For those who are 65 years and above, the figure climbs as high as 87%.

Other findings

Having unsecured loans like credit card bills seems to be something that a significant number of Europeans try to avoid. The survey found that on average 41% paid off these bills as a priority. Credit cards are often a lot more expensive to manage due to interest payments and it can be wise for consumers who experience financial challenges to pay these bills first.

When it comes to prioritising healthcare, such as dental or doctor’s bills, the average figure is 46% for Europe as a whole. In the Netherlands, the healthcare figure is up at 73%, while in the UK, with its state-funded and universal National Health Service, just 31% see this as a priority payment.

At the other end of the priorities list, it would seem that childcare costs rank lowest among European consumers. Here, an average of 20% of Europeans answered that they prioritise paying this bill each month. At 37%, Slovaks far outrank this category of bill compared with the Belgians and French (14%).

Companies facing issues with late payments

Intrum’s European Payment Report 2019 finds that many companies across Europe experience issues with late payments; the bad debt loss increased from 1.69% to 2.31%. Each year, Intrum helps 80,000 clients to receive payment for the services and goods that they have sold.

Though many consumers prioritise paying bills, the companies within the utilities sector can still see issues with late payments. With insight into payment behaviour and professional approach, Intrum can help you speed up late payments and collect unpaid invoices, without harming your customer relationships. Read more about our business solutions here.

Financial literacy key to sound personal economy

“Improving financial literacy across Europe will be key to helping consumers to navigate the financial complexity and related stress that they feel they are facing” says Mikael Ericson, President & CEO at Intrum.

Interested in finding out more about which invoices are prioritised by pay first by consumers in your country?

All results are published in the European Consumer Payment Report (ECPR) 2019. The report is based on a payment behaviour survey of 24,000 individuals in 24 European countries.