The dual challenge – firms wrestle with poor payment and customer cutbacks

With customers struggling to pay bills and reducing their spending as a result, Europe’s businesses need to be flexible and efficient in their collections strategies.

Rising prices and interest rates continue to have a huge impact on Europe’s consumers and businesses. In Intrum’s latest European Payment Report, six in ten of the 10,000 companies survyed say they expect higher inflation (59%) and rising interest rates (57%) to hit their revenues this year. A similar number (57%) say they are concerned about the financial difficulties that their customers are grappling with.

The economic squeeze is undoubtedly making it more difficult for both consumers and businesses to pay their bills. This means many are paying late or defaulting. Six in ten businesses (59%) say they are more concerned than ever about their customers’ ability to pay.

Customers struggling with payment

Rosário C., Customer Director at Prosegur Alarms, a supplier of security services and technology solutions, says the impact of inflation started becoming visible in September last year. “Our customers in Portugal began telling us that they were finding it difficult to pay,” she recalls. “Others didn’t even tell us that they were struggling. They just didn’t pay up.”

Poor payment is hard to handle in good times, but in times of economic hardship, businesses have to walk a fine line between ensuring their own survival and supporting their customers through the difficulties. Two thirds (67%) of businesses have concerns about their company’s immediate cash flow and almost four in ten (38%) expect to take on more debt this year to cope.

“We want to collect, but we want to keep the customer,” says Rosário. “Right now, maybe they can’t pay, but tomorrow they could be a valuable customer once again.”

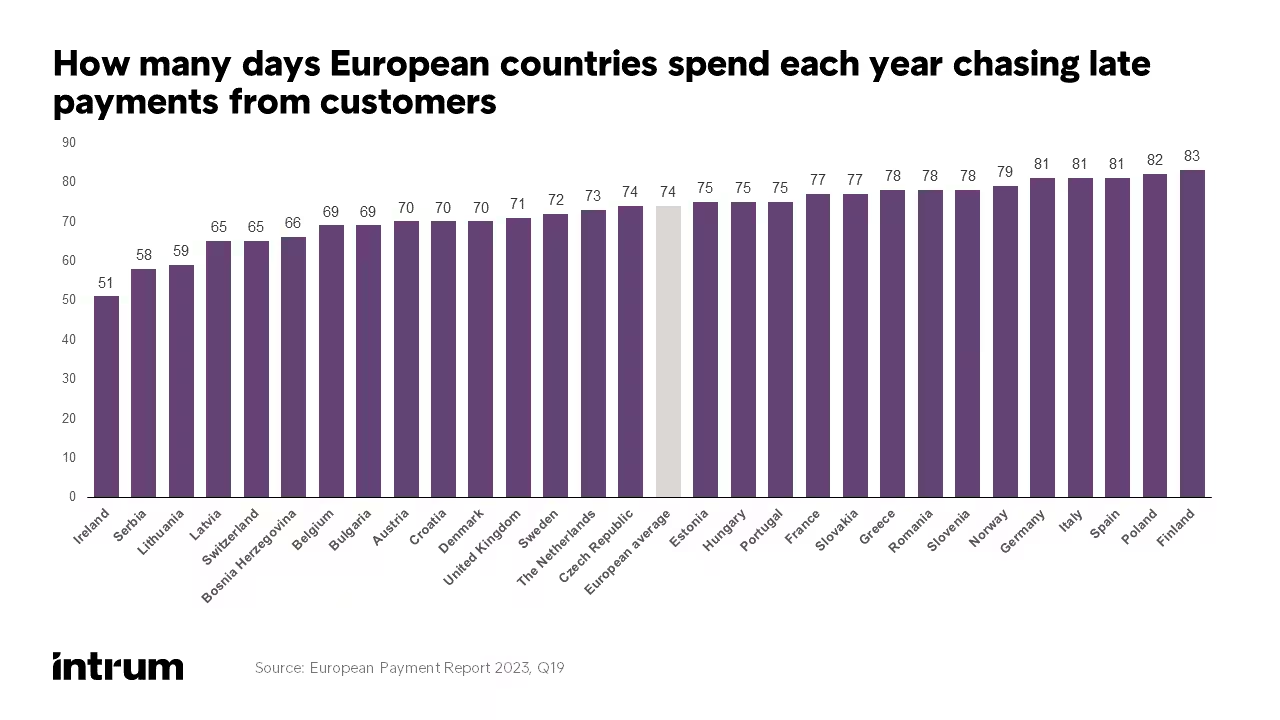

This sensitivity that is key to successful collections in the long term, agrees Intrum CEO Andrés Rubio. Efficient collections processes are important, but businesses need to be flexible and understanding about their customers’ situations. On average, businesses are spending 74 days a year chasing payment – costing the economy €275bn a year. Raising efficiency can make a huge different to the bottom line.

It’s about securing prompt payment for products and services, without putting relationships with customers at risk or spending an unsustainable amount of time chasing payments.Andrés Rubio, Intrum President and CEO

Changing behaviour has long-term effect

As well as late payment, behavioural change in consumers and other customers is a further pressure point for businesses. The natural response of cutting back is reinforcing the slowdown, reducing revenues at the same time firms are struggling with increased costs.

The reality is that customers have needed to change their spending habits, explains Egita K., Senior Credit Risk Manager at the retailer Circle K. “We see a trend for customers to be more prudent in their spending culture, given higher energy and living costs.”

Given this, it is not surprising that over half (53%) of the businesses surveyed by Intrum say they are shifting focus away from growth and towards greater efficiencies and cost savings in response to the economic challenges of rising inflation and interest rates.

Coping means looking at collections in a different way.

Businesses should ensure they have string lines of communication with their customers, clear messaging and tight credit control. It is possible to protect your business and support your customers through trying times. When things improve, those who get this right now will reap the benefits.Manuel Poot, Global Multinational Sales Manager at Intrum

European Payment Report 2023 insights

The insights from this article are based on this year's European Payment Report. Visit intrum.com/epr2023 to learn more.