The damaging effect of late payment

Europe’s late payment culture has long been a hindrance to growth. Now, with inflation and rising prices negatively affecting payments, Europe’s businesses are bracing themselves for even greater challenges.

Cash flow is expected to come under more pressure in the worsening economic environment, and respondents to Intrum’s 2022 European Payment Report, are preparing for tough times.

Businesses believe their cash flow is likely to suffer in the face of macroeconomic challenges such as inflation, rising prices and the effect of the war in Ukraine. However, many admit they lack the agility and expertise to manage the impact of these factors.

Timely payments essential for growth

Four in 10 of the 11,000 companies surveyed say that late payments are already prohibiting the growth of their company. In Slovenia, Bosnia and Lithuania this figure is higher – with more than half of those surveyed claiming it is hampering their growth plans.

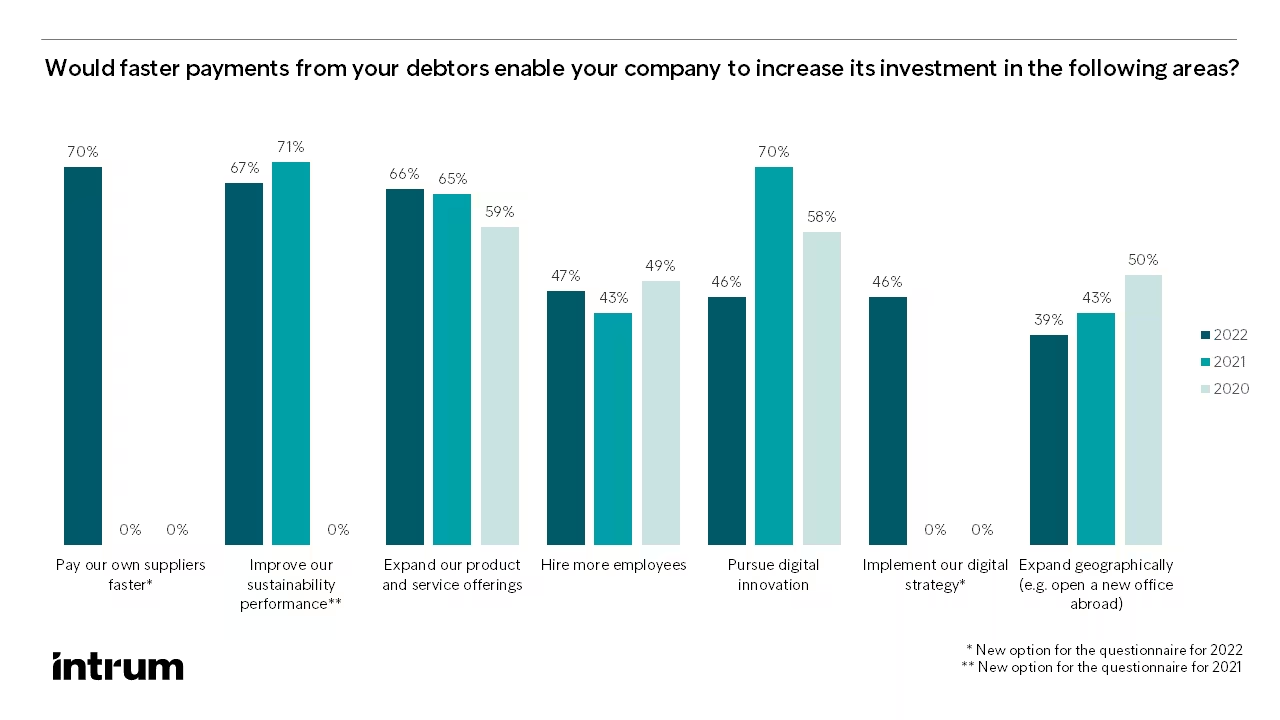

The consequences of late payment are significant and improving the situation would unlock progress in many areas. For example, two in three (66 per cent) respondents say faster payments from their customers would help them expand their product and service operations, and 47 per cent say it would help them grow by hiring more employees.

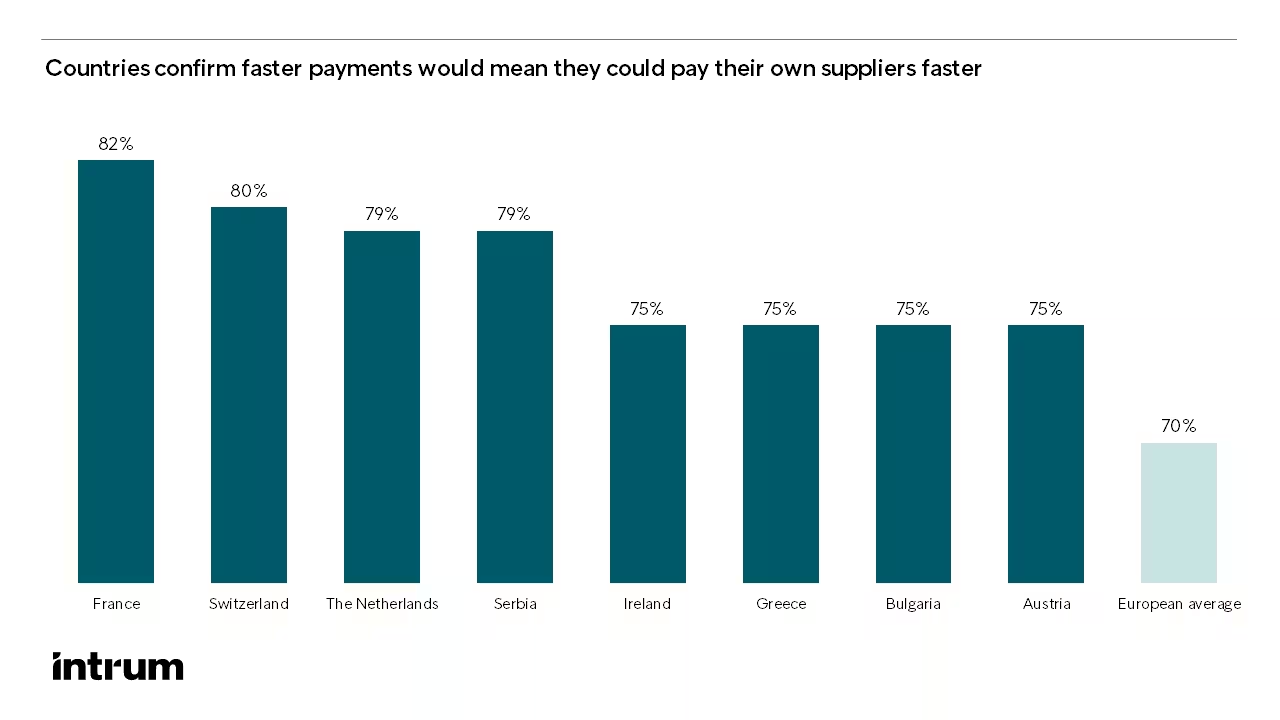

Crucially, 70 per cent confirm that faster payments would mean they could pay their own suppliers faster, demonstrating the knock-on effect late payment has on business. In some countries, this figure is even higher – in France, 82 per cent say this is the case, followed by 80 per cent in Switzerland, 79 per cent in The Netherlands and Serbia, and 75 per cent in Ireland, Greece, Bulgaria and Austria.

Late payment doesn’t happen in isolation. It cascades through businesses and down to their suppliers. The 2022 European Payment Report findings offer a sobering reminder of the impact poor payment practices have on organisations and their employees.Anette Willumsen, Managing Director CMS Sales & Service Development and Markets

Skills and systems refresh needed

Businesses aren’t all prepared for the predicted economic storm. In fact, more than half (53 per cent) of respondents say they would like to improve their management of late payments, but find this difficult due to a lack of skills and resources in-house.

Szilard Szarvas, Risk and Customer Service Manager at road-toll collection business Eurotoll, sympathises with this difficulty. He says embedding new skills and talent within the existing workforce – including the financial and administrative expertise required to manage late payments – is challenging in a competitive labour market.

“Talent is something that is definitely a factor that we face. I’m looking out of the window right now and I see a large accountancy firm that has just announced plans to expand their operations and recruit 500 people. If you cannot match the packages that these firms offer, you will see talent going elsewhere.”

Meanwhile, around half (46 per cent) say their finance and admin systems are seriously outdated and prevent them from being as agile as they need to be.

With the economic environment we are facing, it is important that firms ensure their skills, systems and processes are up to the challenge of tackling late and non-payment. Small problems can rapidly become big threats if they aren’t managed appropriately. Good credit management is about monitoring risk, maintaining customer relationships and reacting early to potential issues.Benjamin Asplund, Global Commercial CMS Director

Strengthening liquidity and debt management is a priority

There are signs that businesses are fighting back. Eight in ten respondents state that strengthened liquidity and cash flow is a strategic priority for the year. More than three quarters (76 per cent) also say improving their debt management is a strategic priority for their business.

These are positive signs and there is much businesses can do, both internally and in using third parties to assist them.

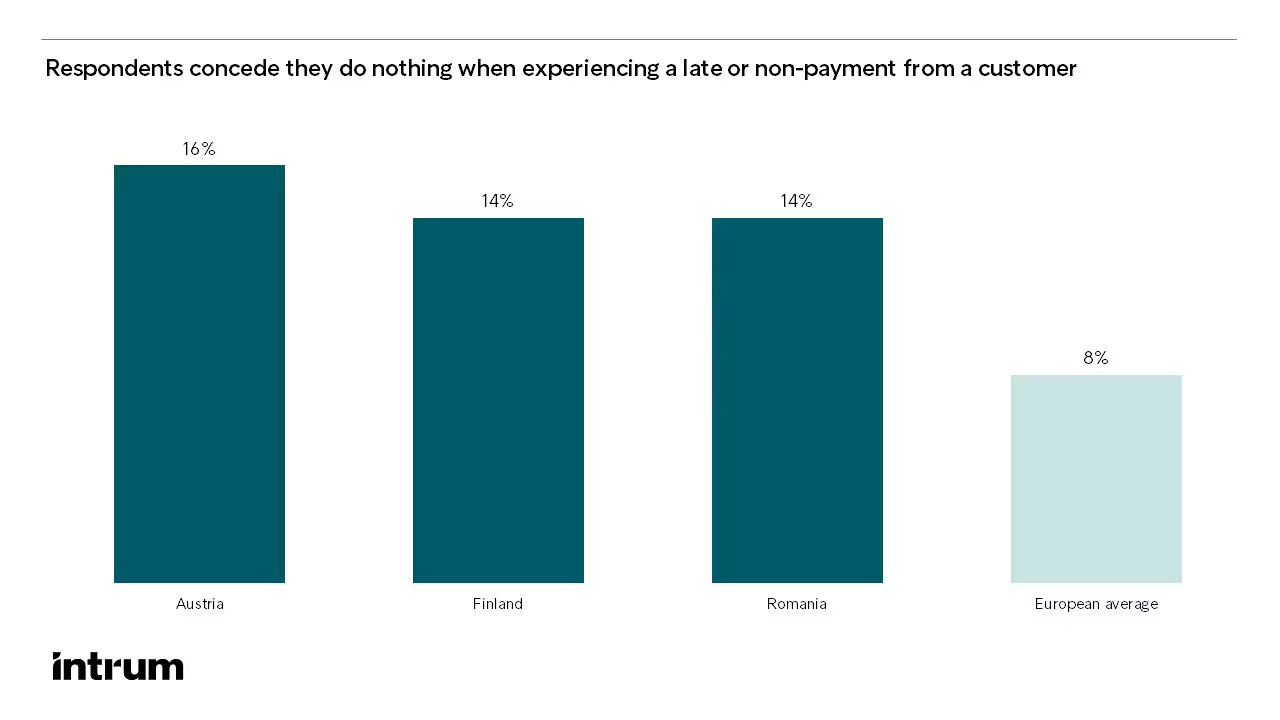

Across Europe, eight per cent of respondents say they currently do nothing when a customer pays late. In some locations this is even higher, which means there is scope for significant improvement. Even among those who are taking action, many are leaving it too long to react. While more than half (57 per cent) say they take legal action against late and non-paying customers, only 17 per cent work with external debt collection agencies.

This is a mistake given that external debt collection agencies are likely to work at an earlier stage of the process, when there is a greater chance both of payment and of repairing the relationship.

Companies themselves acknowledge the importance of tackling early arrears. Of those who said they are making debt management a priority, by far the largest proportion (73 per cent) are focusing on early arrears, while 26 per cent are working with debt collection agencies and 22 per cent digitalising and investing in new technology.

Late payment may seem insurmountable, but there is a lot businesses can do to prepare and protect themselves. Getting those measures in place sooner rather than later will reduce the pressure.Anette Willumsen, Managing Director CMS Sales & Service Development and Markets

Download the full report

The insights from this article are based on the European Payment Report 2022. You can download the full report below.