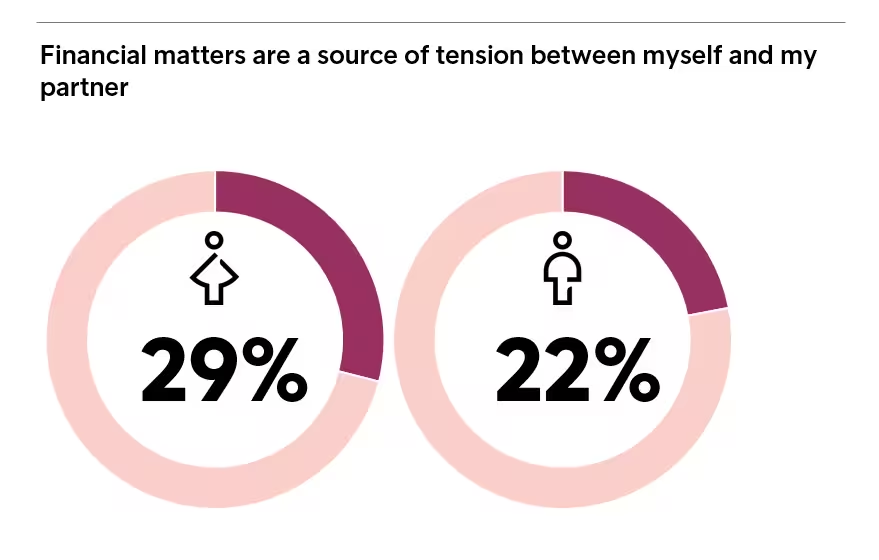

More women than men say finances cause relationship tensions

Insights from Intrum find over one in four women affected.

Money problems are stressful enough when facing them alone, but when they also impact homelife, they can be even more problematic.

The results of a recent survey of European consumers by Intrum shows that financial issues are a significant reason for tensions in a romantic relationship. And the issue is especially pronounced among women respondents.

The European Consumer Payment Report 2019 (ECPR), which looked at the financial behaviour and opinions of consumers in 24 European countries, found that more than 29% of women agreed with the statement that finances caused problems in their relationship. In contrast, just 22% of men cited this as a reason.

When the results are examined by country, it seems that Czech relationships see the most financial tensions (42%), with Greeks (39%) and Latvians (36%) next in line. Italian and Danish relationships (9% and 10% respectively) would seem to be the least affected by money worries.

A moral issue or an income issue?

The Intrum ECPR report finds that more men (41%) than women (39%) are ‘very confident’ about being able to pay households bill on time. Just 4% of women and 3% men are ‘not at all confident’ about being able to do so. However, more women than men say they prioritise paying bills over everyday spending (75% women, 67% men).

This indicates a gap between confidence in being able to pay bills and which bills to prioritise, which perhaps can be explained by employment status among the genders. According to Eurostat data there is still a notable gender difference in the employment rate in European labour markets; more men than women are employed.

Differences in the labour markets also translate into differences in income, which in turn affect the credit and debt collection markets. A higher employment rate leads to a higher income and therefore higher confidence in paying bills on time.

Open communication can help

It’s also the case that more women (24%) than men (22%) agree with the statement that they struggle to talk about finance openly with their partner.

In this category, the European average is 23%, but in Romania the lack of financial openness is as high as 76%, with Czech couples next at 42%. Denmark, Sweden and the Netherlands are at the other end of the scale, on 12%.

Parental couples especially tense over finances

The survey’s results show that parents are clearly more affected by finance issues in their relationship than non-parents. Some 32% of parents say that finances were a source of tension, while just 21% of non-parents say this is the case.

Of course, the financial implications of raising children are clear, and elsewhere in the ECPR 2019 report there are findings which perhaps have a bearing on financial tensions.

These include the fact that, in a six-month period, 38% of respondents have maxed out their credit card at least once to buy an item for a child or children, while, of the 24 percent of Europeans that said they borrowed money to pay bills, more than seven in ten (73%) of parents say they have borrowed money to pay for an item for their child.

Help is at hand

A key finding from the 2019 ECPR is the increasing stress felt among European consumers regarding their personal finances. Better access to financial education at different stages in life, has a crucial role to play. Intrum encourages anyone who is struggling with unpaid debts, to seek help from our experienced team of advisors.Anna Fall, Chief Communications Officer at Intrum.

Looking for more information on financial issues?

You can find out more about this and other financial issues in the European Consumer Payment Report (ECPR) 2019 from Intrum. The report is based on a payment behaviour survey of 24,000 individuals in 24 European countries.