Consumer spending teetering on the edge

European consumers are living month to month, with many having worked through their savings buffers and struggling to make ends meet in the difficult economic climate.

Intrum’s 2023 European Consumer Payment Report shows that three in four consumers are now breaking even or overspending on a monthly basis, unable to put any money aside for unexpected costs.

This is a change to the Covid era. Many consumers saved money during the pandemic as they had fewer opportunities to spend. Now, the balance has tipped significantly as households struggle to meet their costs, given the failure of wages to keep up with rising prices.

Overspending levels high as most break even

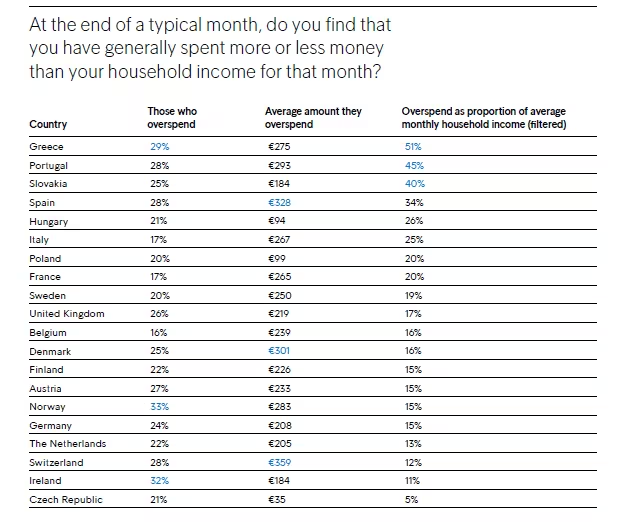

While wages have risen, they have not kept pace with the cost of living, leaving consumers scrabbling to meet the shortfall. A quarter of Europe’s consumers now overspend each month, by an average of €232, adding up to a massive €2,784 a year. The biggest overspenders are in Switzerland, Spain and Denmark, where spending outstrips income by over €300 a month.

However, when you look at overspending relative to average income, Southern European and CEE countries are those exceeding their budgets by a significant proportion per month – 51 per cent in Greece, 45 per cent in Portugal and 40 per cent in Slovakia.

These are worrying figures. Over time, relatively small amounts can add up to a significant household debt burden that businesses and lenders will need to combat. While budgeting is an important tool to help consumers cope, there is only so far their costs can be cut back.

Modern payment methods challenge money management

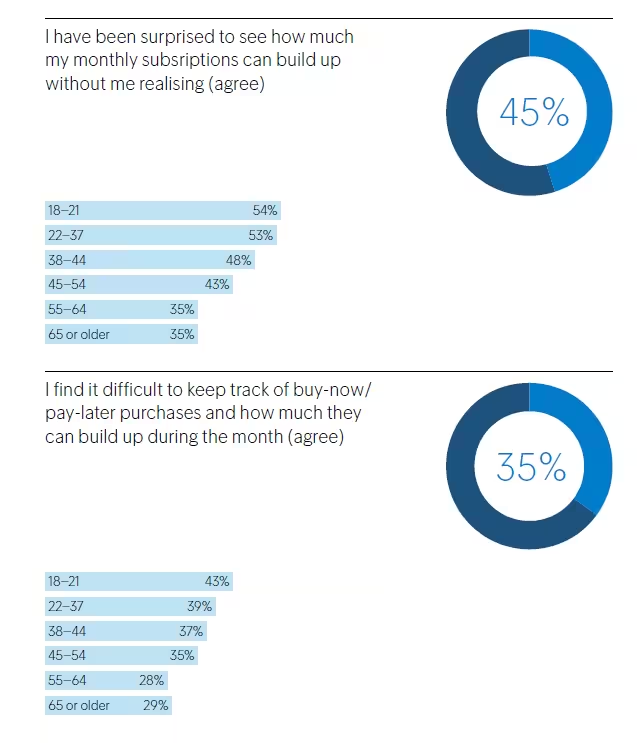

Many consumers are also feeling out of depth when it comes to managing their money. Survey respondents report that they are surprised how quickly their subscription services add up without them noticing, with Millennial and Generation Z consumers most adrift when it comes to managing these kinds of payments.

Meanwhile, while consumers say they value the flexibility offered by businesses in payments, more than a third (35 per cent) find it tricky to keep track of their buy-now/pay-later purchases.

At a time when careful money management matters more than ever, almost a quarter of consumers are telling us they have less visibility of their short-term borrowing than in the past.

Lenders need to ensure they have strong communications with customers and early-warning indicators so they can tackle any problems before they reach crisis-level.

For more information on consumer trends and payment behaviour, download the full European Consumer Payment Report, published November 2023.