29.06.2024

European companies spend 73 days chasing debt in 2024

A significant burden for European businesses, late payments consume an average of 73 business days. This article explores the variations in time lost across different countries, highlighting the ongoing challenges of managing receivables in the current economic landscape.

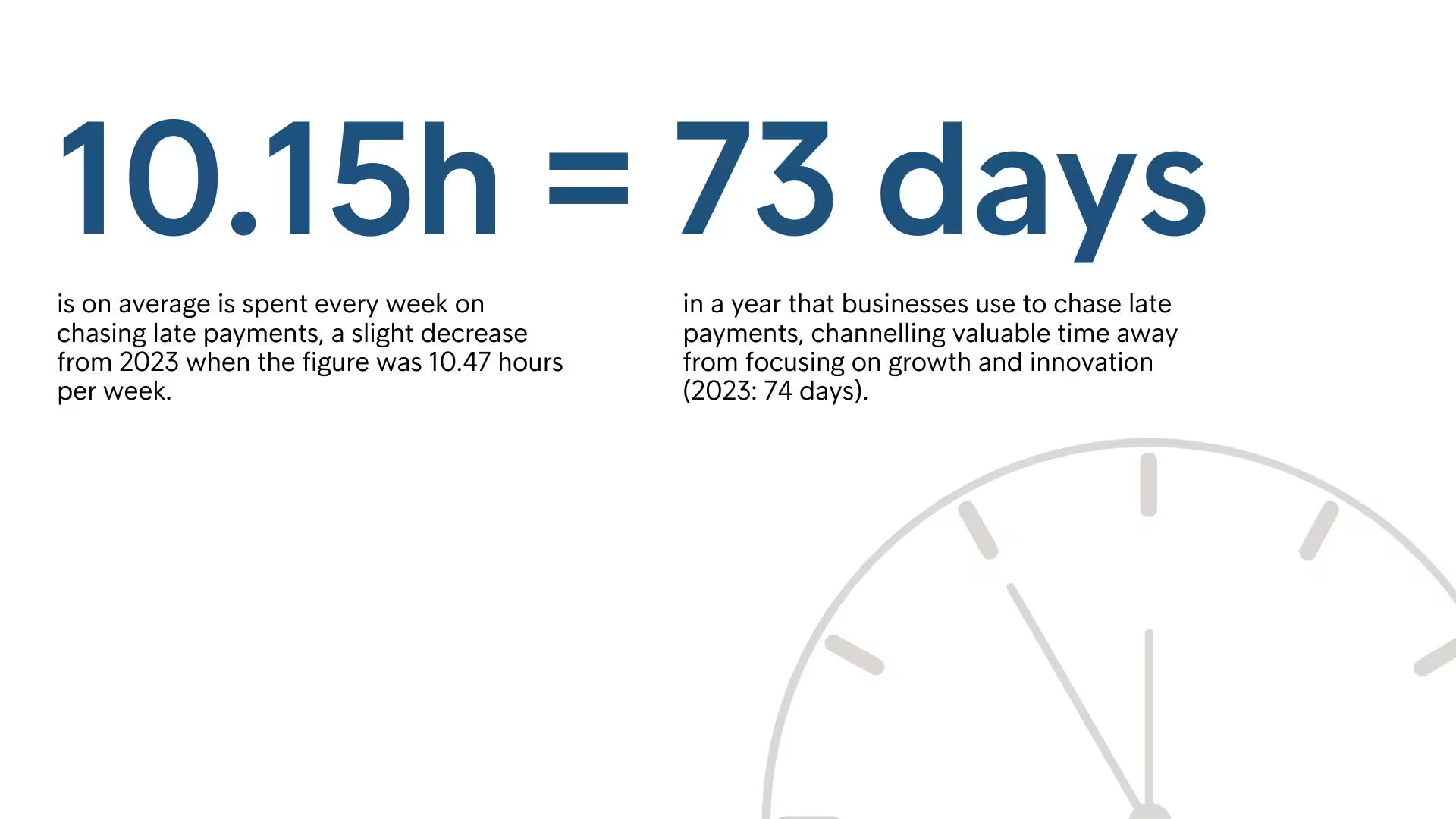

Many European businesses are now making slightly less effort to chase up late payments. The average business spends 10.15 hours a week on this, down from 10.47 hours in 2023. And although 38% of businesses still spend more than 10 hours a week chasing late payments, this is down from 41% in 2023.

The cost of chasing late payments

Late payments continue to be a pressing issue for companies across Europe, impacting their operations and financial health. On average, businesses spend 73 days per year chasing overdue invoices, which diverts valuable resources away from growth and innovation efforts.

Read also: European comanies have €10.5 trillion in oustanding receivables.

2023: 74 days chasing debt

In the 2023 edition of the European Payment Report, Intrum calculated that businesses are spending an average 74 days a year chasing debt.

Using the average salary per country provided by the OECD, this translates into a total annual cost to the European economy of approximately EUR 275 billion in 2023, solely from efforts to chase payments that are not made within the agreed due date. Imagine what this enormous sum could mean if invested in green technology and innovation.

Read also: Europe's €275bn problem.

Country-specific insights

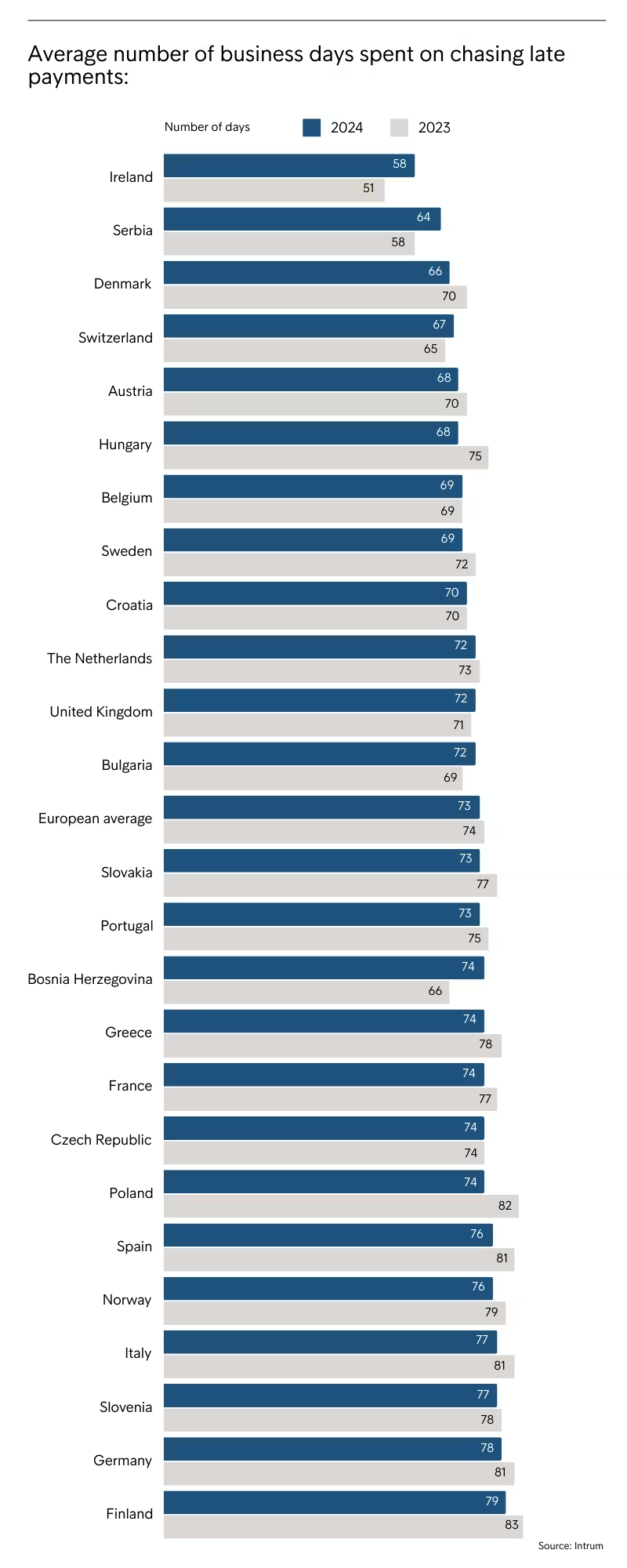

The experience of European companies varies significantly when it comes to the number of days lost chasing late payments. Understanding these country-specific dynamics can provide valuable insights into payment practices across the continent.

Austria and Belgium:

In Austria, companies lose an average of 68 days chasing payments, while Belgium follows closely at 69 days. Both countries reflect a relatively efficient payment culture compared to the European average, yet they still encounter significant challenges.

Finland:

Finland presents a stark contrast, with businesses spending an average of 79 days on payment collection. This extended timeframe highlights the need for improved payment practices to mitigate cash flow disruptions.

Germany and Italy:

Germany reports a substantial 78 days lost, while Italy is not far behind at 77 days. These figures underscore the importance of timely payments for maintaining operational efficiency and financial stability in larger economies.

United Kingdom:

In the UK, the situation appears more optimistic, with businesses losing only 72 days. This comparatively lower figure suggests that UK companies may be implementing more effective payment practices, potentially due to stricter regulations or cultural differences in business transactions.

The Southern and Eastern Regions:

Countries in the southern and eastern parts of Europe, such as Greece (74 days), Portugal (73 days), and Serbia (64 days), experience varied challenges. While some countries face high averages, others are slightly more favourable, indicating a diverse landscape of payment behaviours.

Want to explore more?

Published in June 2024, the European Payment Report provides insights into the payment behaviours of European businesses and examines trends related to late payments, invoice payment practices, and overall financial risk.