26.06.2024

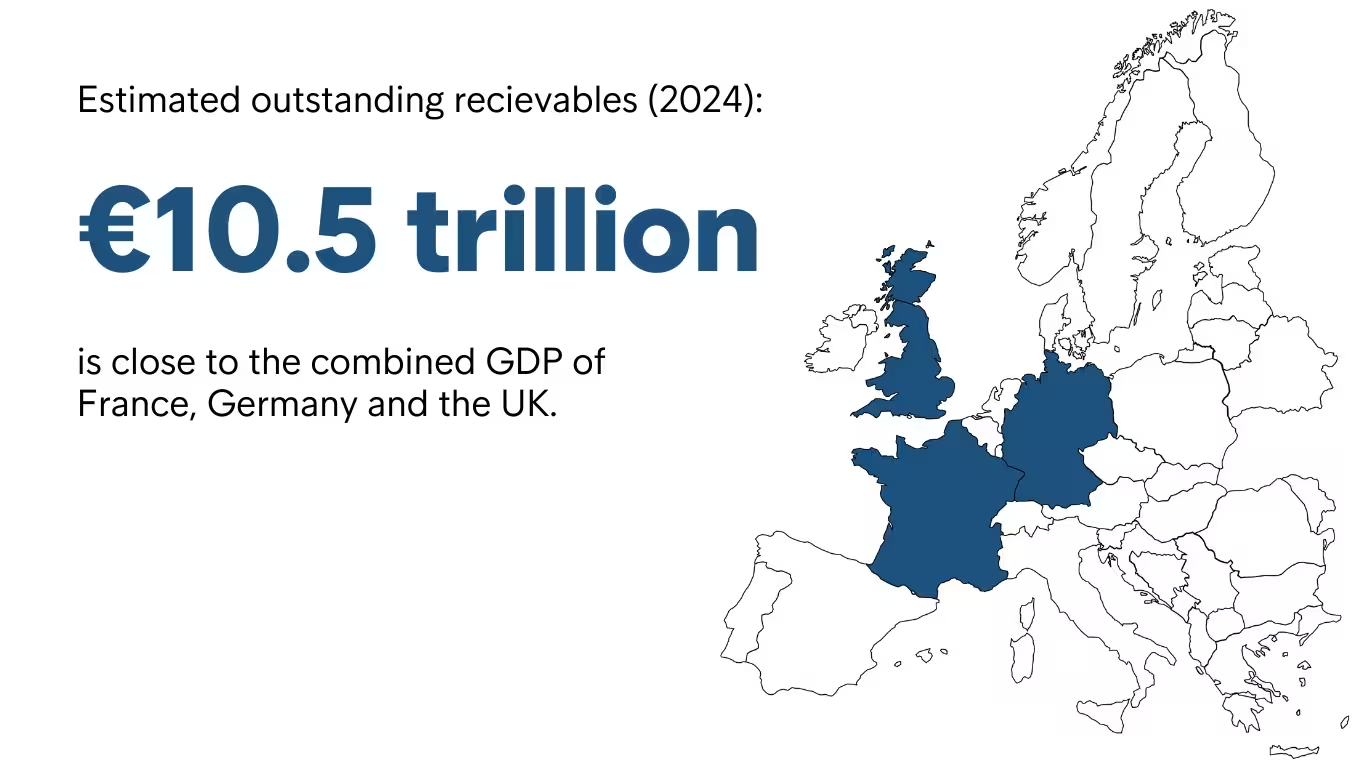

2024: €10.5 trillion oustanding receivables

European businesses estimate that they are owed a staggering €10.5 trillion in receivables, an amount close to the combined GDP of France, Germany, and the UK. The risk of late or unpaid invoices increases, putting significant pressure on businesses' cash flow, liquidity, and potential for future growth.

Outstanding receivables across Europe are esitmated to be around €10.5 trillion, raising concerns over the financial health of European businesses. This sum is nearly equivalent to the combined GDPs of France, Germany, and the UK, underscoring the scale of the potential risk.

This figure includes all goods and services sold but for which payment is still pending. Based on Intrum’s experience, a portion of this sum is likely to be delayed or, in some cases, not paid at all.

What if the amount is not paid on time or in full?

The longer these sums remain unpaid, the greater the risk to businesses' operational stability, ability to cover costs, and potential for future investments in innovation and growth. Companies must prioritise addressing late payments or risk facing insolvencies, liquidity crises, and a cascading effect across their supply chains. Businesses are today spending 73 business days on average on chasing late payments.

Understanding the credit risks

Adding on the increased interest rates and raging inflation across the EU, this creates a significant risk for businesses that rely on timely receivables to maintain cash flow.

Compounding this issue is the fact that many businesses lack the tools or processes to properly assess the creditworthiness of their customers. This lack of understanding increases the chances of granting credit to customers who may default, further exacerbating the problem. According to insights from nearly 10,000 executives, more than half (51%) of businesses struggle to fully understand their clients' ability to pay on time.

In an economic environment as complex as today’s, businesses must do more to protect their receivables and ensure payments are made on time. €10.5 trillion in outstanding payments is not just a number; it represents a serious risk to liquidity and long-term stability across Europe.Andrés Rubio, President & CEO of Intrum.

Payment behaviours vary significantly across Europe

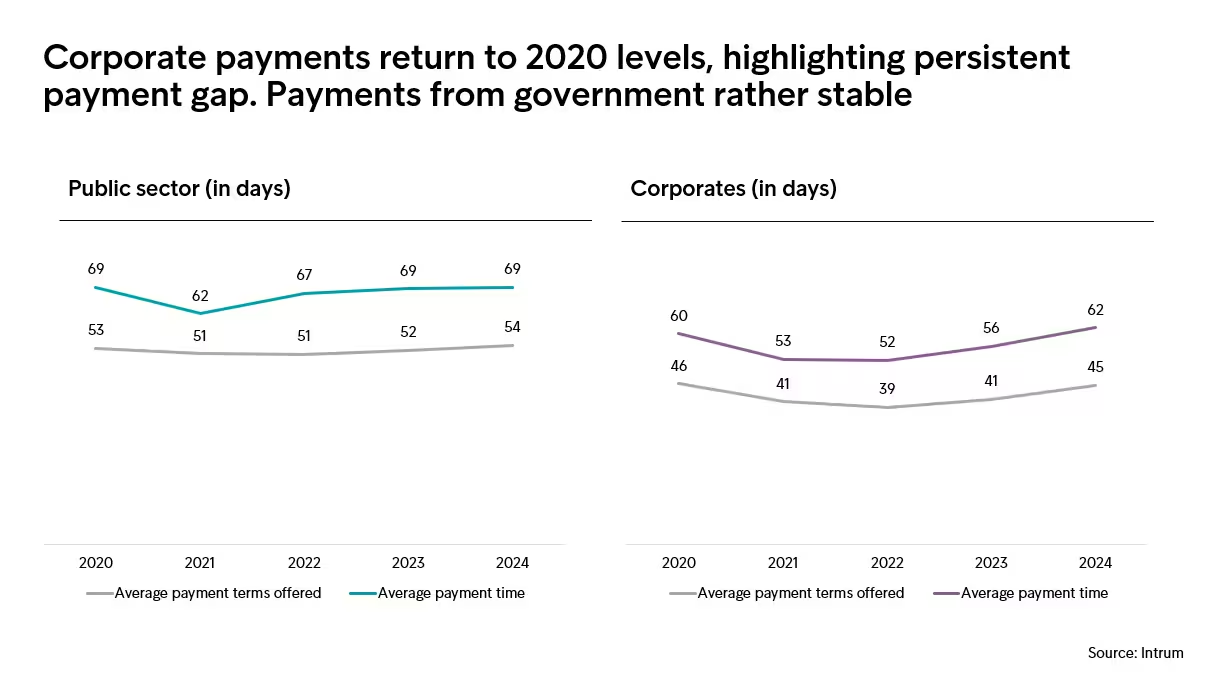

European businesses report a rather stable payment gap—the difference between the terms set for payments and the actual time businesses must wait to receive funds.

In 2024, on European average, both public sector and B2B paid their invoices, on average, 16 days later than agreed.

Country-specific differences in payment behaviour

Payment behaviours vary significantly across Europe, with some countries experiencing more severe delays than others. According to the European Payment Report 2024, businesses in certain regions are facing increasing pressure from growing delays.

Read: Payment discipline: which countries take longest to pay?

Want to explore more?

Published in June 2024, the report provides insights into the payment behaviours of European businesses and examines trends related to late payments, invoice payment practices, and overall financial risk.