11.10.2024

Consumers are confident about meeting their commitments

Insights from a pulse survey conducted in January 2024, indicate a positive development as some consumers feel that their household finances are improving. Consumers are confident about meeting their commitments – but financial wellness is about more than paying bills

At first sight, the gloom is lifting for European consumers. Most notably, the cost-of-living crisis that was front of mind in our last ECPR study may be starting to ease. Inflation across the Euro zone was at 2.9 per cent by the end of 2023, down from 9.2 per cent a year previously; the European Commission expects an average inflation rate of 3.5 per cent for 2024 as a whole. That could pave the way for interest rate cuts in the months ahead. In the eurozone, some analysts are predicting as many as four rate reductions from the European Central Bank (ECB) in 2024.

The outlook for economic growth in Europe is also improving

The International Monetary Fund (IMF) expects growth this year of 0.9 per cent in the Euro zone and 0.6 per cent in the UK, up from 2023 estimates of 0.5 per cent for both. These are hardly buoyant projections, but they at least offer hopes of recovery. Even in Germany, which has flirted with recession, the IMF forecasts a bounce-back.

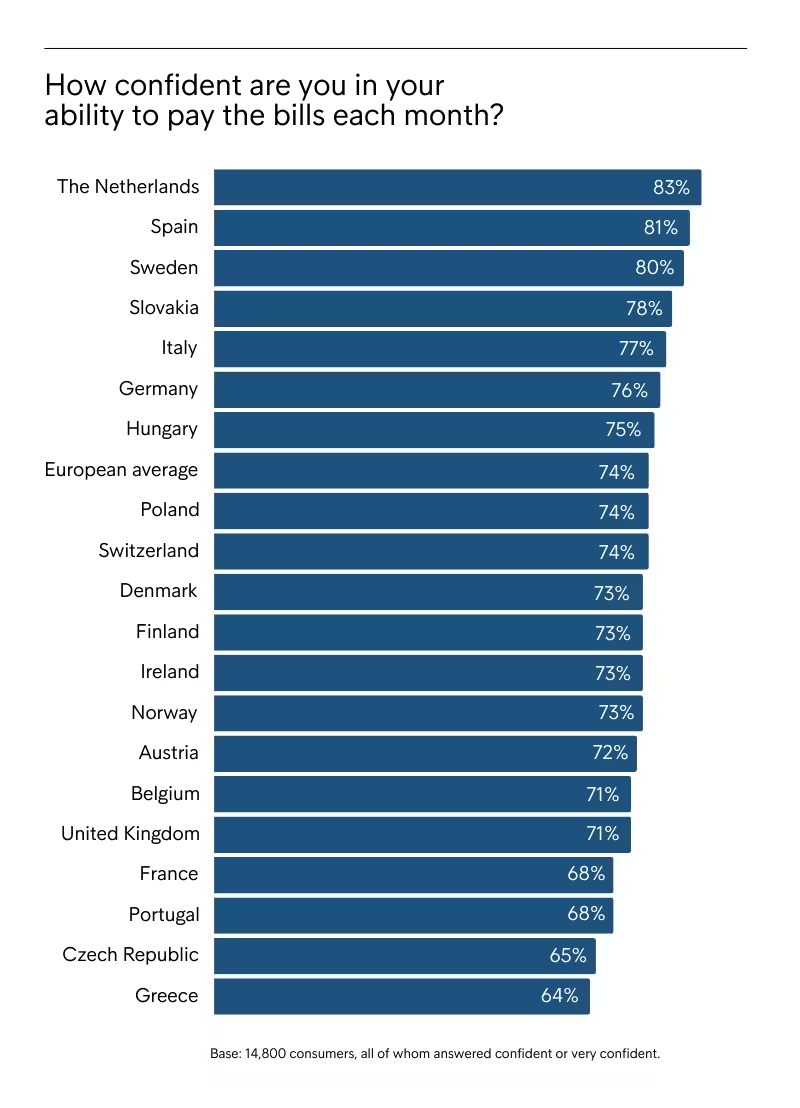

3 in 4 are confident about their ability to pay their bills each month

Despite lingering uncertainty, overall optimism is increasing, with forward-looking indicators pointing to an improvement in economic conditions. Indeed, most Europeans in Intrum’s new survey are feeling relatively upbeat about their household finances.

Almost three-quarters (74 per cent) are very or fairly confident about their ability to pay their bills each month – just 11 per cent are worried about keeping up with such payments. Consumers have also benefitted from adopting greater financial discipline: as a result, seven in 10 are confident they can keep track of their monthly spending.

The 50-30-20 rule for spending

Any improvement in consumer resilience is heartening. Nevertheless, having the money to cover bills is not the only factor influencing financial wellbeing. Evidence persists of underlying strains on household budgets. The necessities may be covered, but potentially at the expense of discretionary spending and saving for the future.

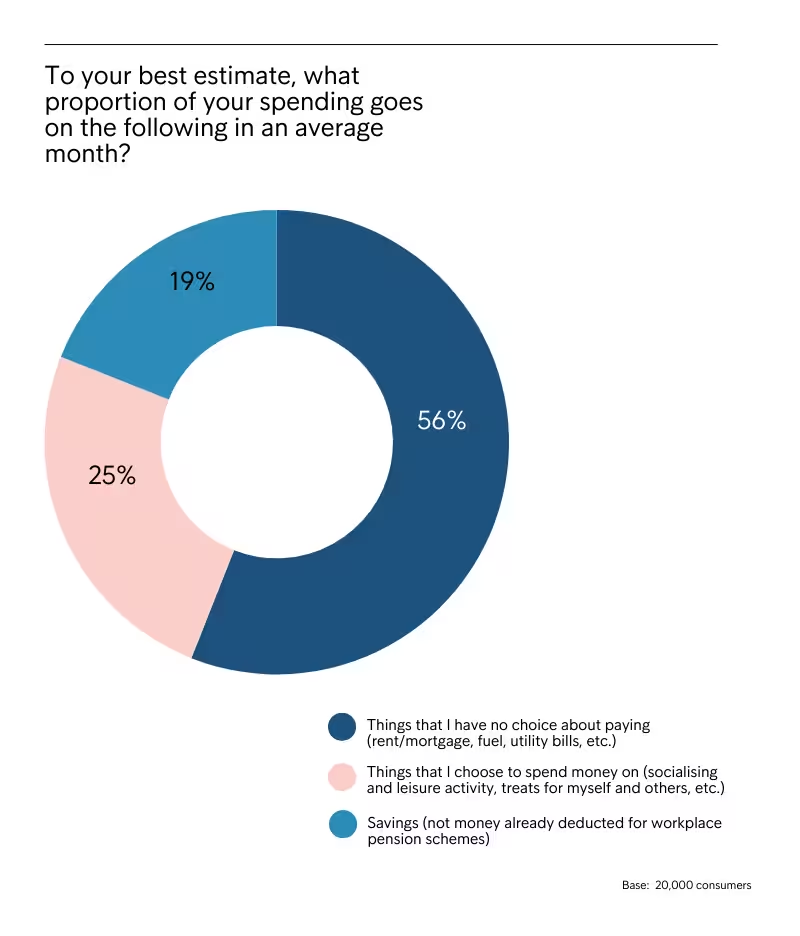

Personal finance advisers and other expert bodies often advise people to follow the 50-30-20 per cent rule for spending – allocating these percentages of their income, respectively, to essential spending, discretionary spending and savings.

However, with essential spending now accounting for 56 per cent of the average European’s monthly income – reflecting high prices and borrowing costs – spending on nice-to-have products and services has, by necessity, fallen to only 25 per cent.

But financial wellness is about more than paying the bills

The danger is that Europeans are spending within their means but merely surviving rather than living. This has implications for wellbeing and mental health, which we come back to later on, as well as for the short-to-medium-term prospects of businesses exposed to consumers’ discretionary spending patterns.

Want to explore more?

Released in March 2024, the European Consumer Payment Report White Paper provides an overview of consumers' ability to pay bills on time and highlights evolving attitudes towards financial commitments. The report is based on insights from 20,000 consumers in 20 countries.