05.11.2024

Where are Europe's most financially resilient consumers?

Despite steady improvements in consumer confidence across Europe in 2024, many households continue to grapple with financial challenges. Intrum's European Consumer Payment Report (ECPR) reveals that, while more consumers are paying bills on time, regional disparities and heavy reliance on short-term credit highlight ongoing economic fragility. The survey offers a snapshot of financial resilience across Europe, showing that while Southern Europeans rank high in timely payments, many Northern households remain vulnerable.

The latest data from the Intrum European Consumer Payment Report, published November 2024, indicates that European households are gaining confidence in their ability to meet monthly commitments.

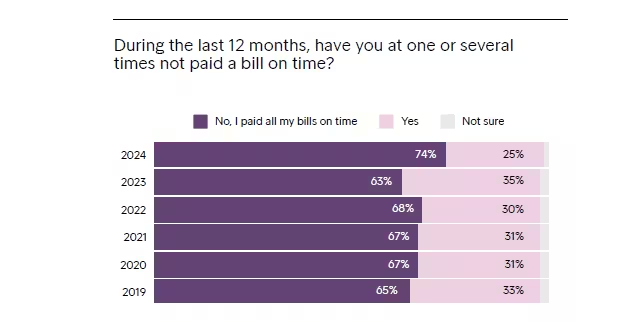

Over the past 12 months, 74% of respondents reported that they managed to pay all their bills on time – a notable improvement and the highest level recorded since 2019. This upswing in timely payments largely reflects the stabilisation of macroeconomic conditions across Europe, with inflation rates beginning to ease and consumer incomes adapting post-pandemic.

However, consumer confidence remains fragile due to ongoing challenges such as elevated borrowing costs, persistent inflation, and volatile energy prices. While many are meeting their financial obligations, this is often a result of adapting to reduced disposable incomes. Households across Europe are making do with less, having adjusted their spending and become more financially cautious.

Southern Europe leading in payment discipline

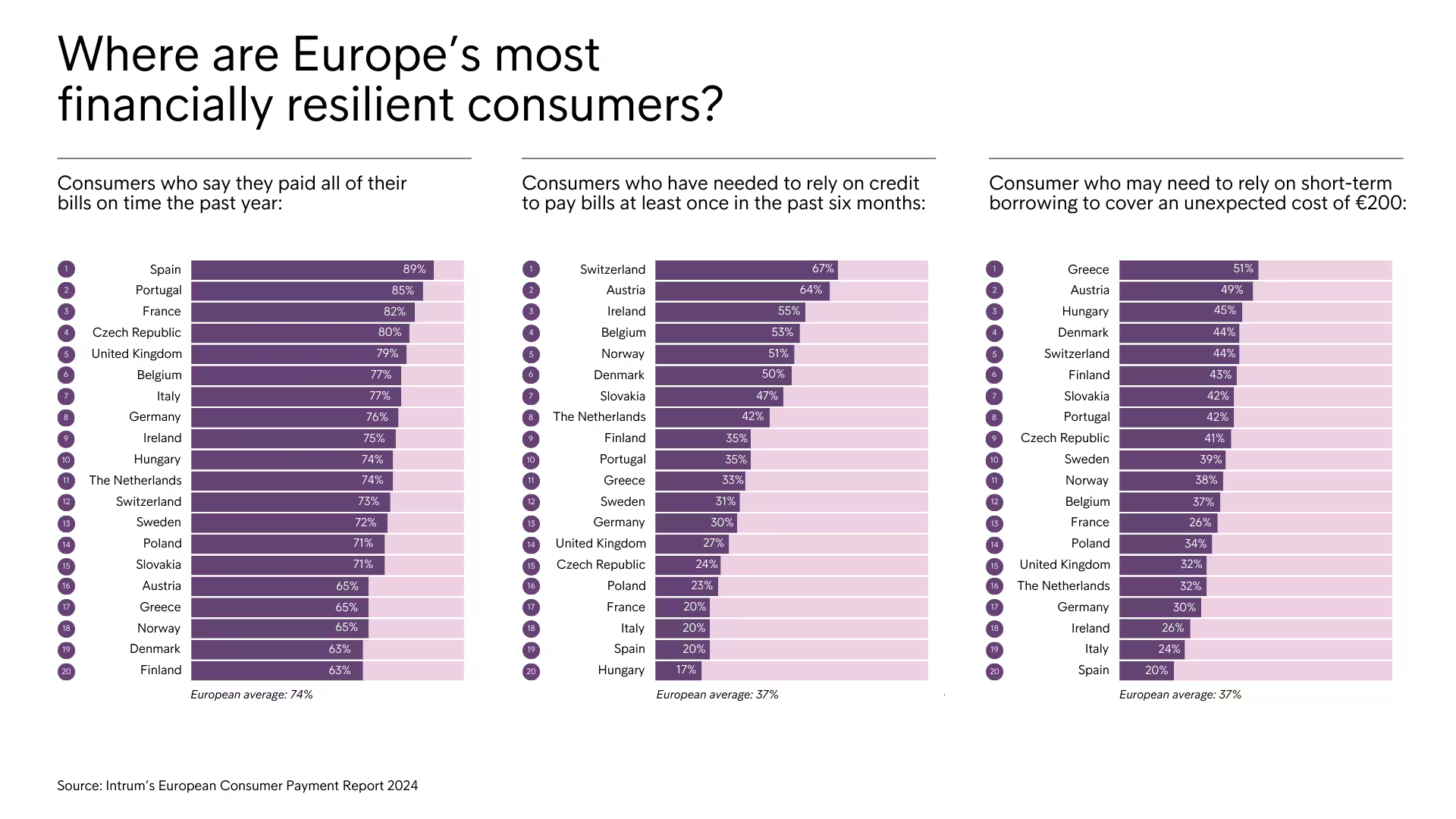

The survey uncovers significant regional differences in financial resilience, with Southern European countries displaying the strongest ability to manage monthly payments.

Spain and Portugal lead the continent, with 89% and 85% of respondents, respectively, reporting consistent on-time bill payments. In contrast, Nordic countries such as Norway (65%), Denmark (63%), and Finland (63%) report lower levels of payment punctuality.

This gap is largely attributed to the high debt-to-income ratios in Scandinavian countries, where flexible interest rates and high mortgage costs add financial strain.

The data indicates that while Southern Europe benefits from more manageable debt levels, Nordic households are more exposed to economic fluctuations due to their higher reliance on flexible financial products.

Short-term borrowing remains a lifeline for many

Despite positive trends, Intrum’s report shows that a significant portion of consumers across Europe still rely on short-term borrowing to bridge financial gaps.

About 37% of consumers report turning to credit cards or short-term loans to cover essential expenses. This reliance on credit suggests that many households remain vulnerable to cost-of-living pressures and continue to struggle with basic financial stability.

The reliance on credit is particularly prevalent in areas where the cost of living has outpaced wage growth, putting additional pressure on consumers to maintain their financial commitments. While some consumers can adjust their spending, others find themselves dependent on borrowing as a safety net, which can further exacerbate their financial vulnerabilities.