03.10.2024

Corporate indebtedness in Europe

Corporate indebtedness in Europe has become a critical concern as economic pressures push insolvency rates higher. With businesses facing mounting challenges from inflation, supply chain disruptions, and rising interest rates, understanding how these factors interplay is key to navigating the uncertain road ahead.

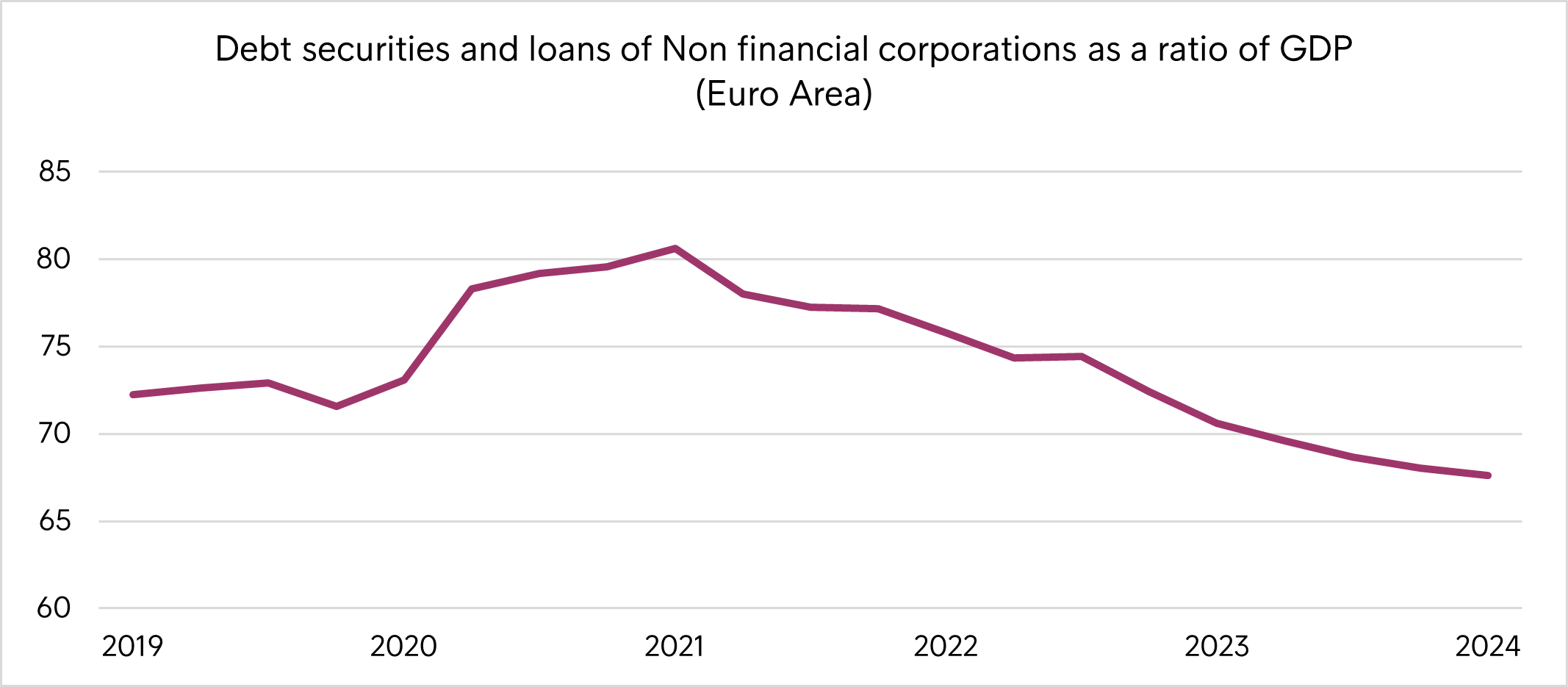

Pandemic-driven debt: A long-lasting impact

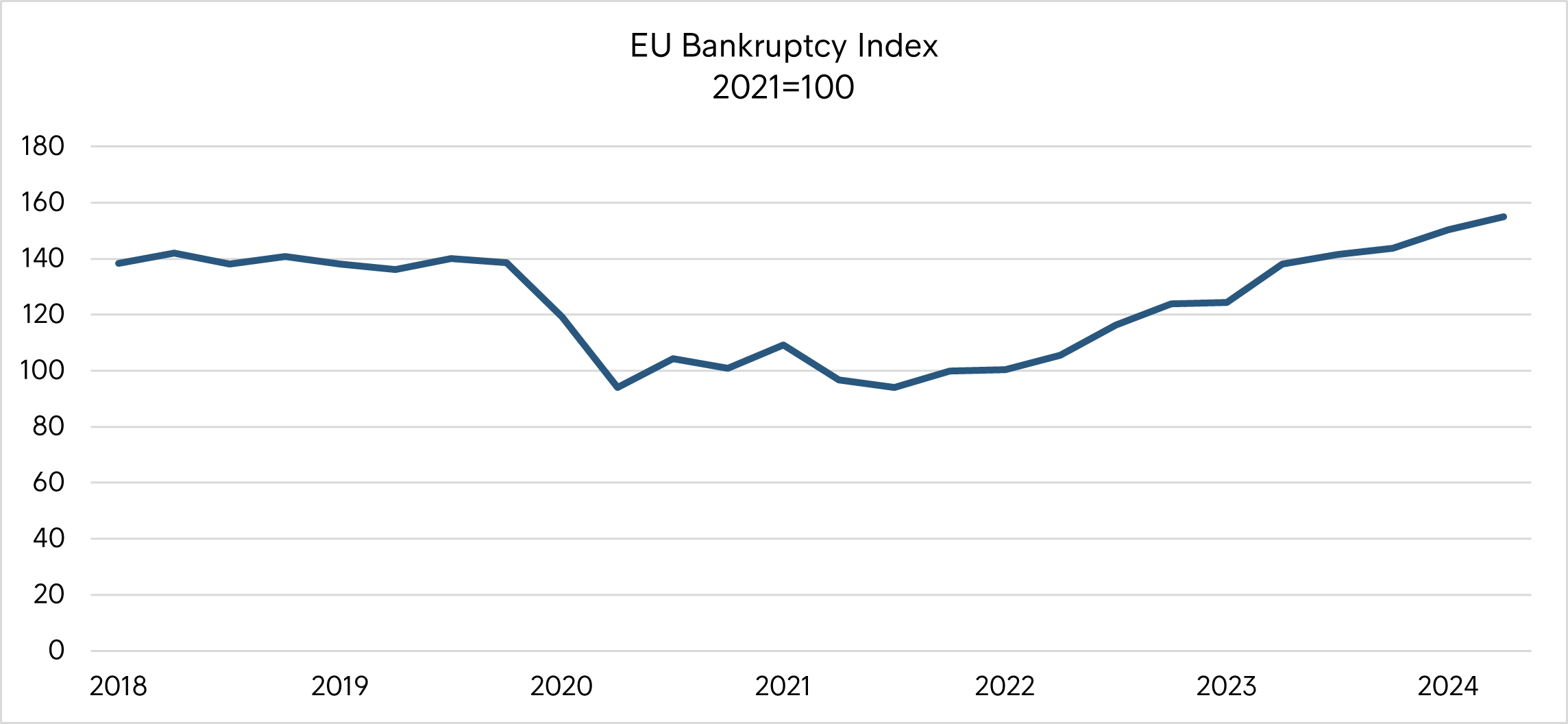

Corporate debt levels surged during the pandemic as businesses sought relief through government loans and favourable borrowing conditions. However, the conclusion of pandemic-related support, combined with tougher economic circumstances, has seen a swift reversal in these trends. As companies move to reduce debt in a more challenging financial landscape, insolvencies are increasing at an alarming rate.

The rise in insolvency filings across Europe reflects this ongoing pressure. In key markets such as Germany, Italy, and France, corporate insolvencies are set to end 2024 significantly above pre-pandemic levels. The EU’s bankruptcy index paints a clear picture of businesses struggling to adapt to the withdrawal of financial support and heightened costs across the board.

Rising costs and strained profitability

A major driver behind the spike in corporate bankruptcies is the combination of increased input costs, driven by supply chain instability and soaring energy prices, and weakened consumer demand. Businesses in industries reliant on cheap debt, such as commercial real estate, have been particularly vulnerable to rising interest rates, which have dramatically increased debt-servicing costs.

This squeeze on profitability has left many companies in precarious positions. Although lower interest rates are anticipated in the near future, the benefit may not be sufficient to stave off insolvencies for businesses already on the brink. As profitability continues to be challenged, even rate cuts may not ease the burden quickly enough to reverse the rising tide of bankruptcies.

The path to recovery will require a more holistic approach

While the European Central Bank’s expected easing of policy rates offers some hope for businesses, the corporate sector must remain cautious. Simply reducing borrowing costs is unlikely to deliver immediate relief for firms with entrenched debt issues. The path to recovery will require a more holistic approach, where businesses reassess their debt structures and seek sustainable profitability through cost control and operational efficiency.

Even with rate cuts on the horizon, the question remains whether they will be enough to significantly impact corporate insolvencies in the short term. Firms need to be proactive in adjusting to this new economic reality.Anna Zabrodzka-Averianov, Senior Economist at Intrum

Want to explore more?

Published October 2024, the 11th edition of Economy in Focus delivers key insights into the pressing issues surrounding corporate and household indebtedness in the EU. As we enter a monetary policy easing cycle, this report uncovers how rate cuts will affect businesses and households differently, and whether they will be enough to counter growing financial pressures.