Employee pay demands add to business pressure

Employees faced with cost of living increases are demanding higher wages in almost all businesses, according to Intrum’s latest research. Experts say this could reinforce inflationary pressures and slow economic growth.

Businesses across Europe have been struggling with the impact of soaring inflation – experiencing the highest rates in decades. This is squeezing customers, slowing investment and raising the cost of goods and funding, making many businesses anxious about their future.

Intrum’s latest annual European Payment Report (EPR), which surveys more than 10,000 businesses across Europe, found that inflation is restricting the ability of more than half (51%) to grow the business and seize new opportunities.

Rising utility bills, and rapidly increasing rents are piling on the pressure for both households and businesses.

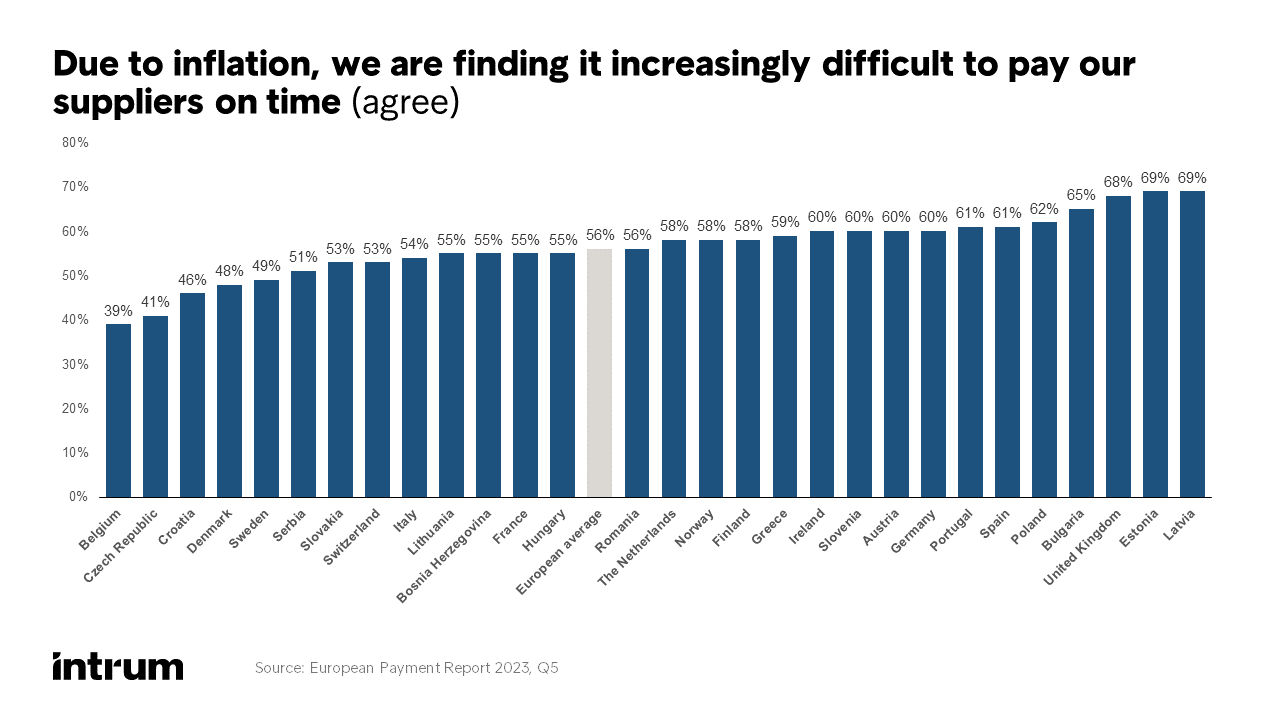

Intrum’s survey shows that over half (56%) are struggling to pay their own suppliers on time because of inflation, and the same number are becoming more cautious with their borrowing and spending plans.

Wage demands adding pressure

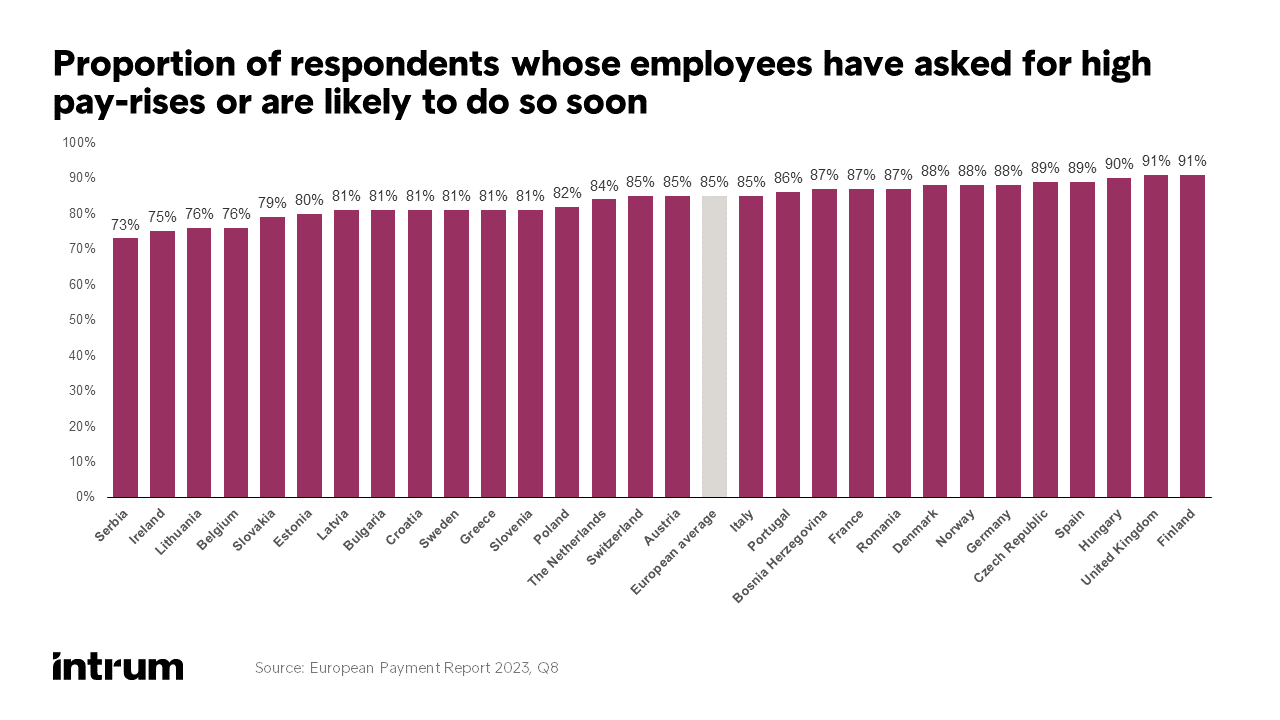

Not only are external costs up, an additional squeeze on businesses is coming from within. Consumers are struggling to meet the rising costs of living and have faced a dramatic drop in purchasing power. As a result, almost nine in 10 (85%) firms report that their employees are pushing for larger than usual pay rises or are likely to do so in the coming months. In more affluent countries, including the UK and Finland, the figure exceeds 90 per cent.

This desire is reflected in strike action, with trade unions springing into action to support workers. Some of the biggest strikes in decades are crippling the transport systems in Germany, France and the UK, for example.

The wage negotiations that started earlier this year have been among the most debated in a decade. In all European countries, we have seen vast protests from workers in different sectors for much higher pay rises than usual. We still have a strong labour market, which puts employees in a good position to demand higher wages, forcing companies to accept these terms.Anna Zabrodzka-Averianov, Senior Economist at Intrum

The need for higher salaries is understandable given the rising cost of living. Separate Intrum research suggests that parents of young children are finding inflation particularly difficult to manage.

Demands for pay-rises are, however, adding to business leaders’ problems. More than half (53%) of respondents are concerned about their ability to meet this rising employee demand for higher wages. Small and medium-sized businesses are more worried than larger firms – 55% said this is a concern compared with 49% in larger organisations.

Companies unable to pass on all costs

Zabrodzka-Averianov believes that demand for higher pay will become increasingly problematic. “The risk is that these wage increases add to the inflationary pressure, as companies transfer at least some of their increased costs to the prices they charge for goods and services,” she explains.

However, it is not possible for most companies to recoup all of their costs in this way and stymying growth is another concern. “There are difficult decisions to make. Around half want to grow their businesses but 70% indicate that cost cutting is the top priority for 2023 and that will have implications for the future. Unfortunately, a lack of investment in growth will mean slower growth in the near-term as well.”

Also, those companies who do not have sufficient financial buffers and are not able to transfer higher costs onto their consumers could be faced to go out of business and the number of bankruptcies has increased sharply since mid-2022, rising above pre-pandemic levels. At the same time, in some sectors, there has been excessive price increases using energy crisis as an excuse to widen profit margins, which also adds to inflationary pressures.

There are difficult decisions to make. Around half want to grow their businesses but 70% indicate that cost-cutting is the top priority for 2023 and that will have implications for the future. Unfortunately, a lack of investment in growth will mean slower growth in the near time as well.Zabrodzka-Averianov

Insights from the European Payment Report 2023

These insights are taken from our latest study. You can access the full European Payment Report 2023, a white paper breaking down the countries' results, plus a recording of our webinar below.