A brief history of the European debt collection industry: The road to empathetic problem-solving

Over the centuries, the credit management industry has gone from imprisoning debtors to helping them become debt-free. Today, that approach is aided by an increasing number of digital tools. Recent developments also build on clearer regulatory frameworks, which help all parties fulfil their obligations.

Predecessors to today’s credit management companies emerged in Europe in the late 1800s, to help creditors recover their debts.

In France, Eugene Francois Vidocq (1775–1857), a criminal turned criminalist, seem to have used his private detective agency to collect debts. In Germany, debt collectors emerged in the 1870s from credit reporting agencies established on American and English models. In Denmark, Købmandsstandens Inkassoservice can be traced to 1870, while in Norway, Bonnevie Angell Bureau came in 1876 and Lindorff in 1898.

This was a time when new legal tools moved the focus for debt collection from the debtors’ person to their income and assets. Instead of putting debtors in prison, agents began working with them to extract value from their possessions. A new era of debt recovery was born.

New economic conditions

Debt collection agencies started looking even more like today’s around World War I. New economic realities played a part in this. Also, the installment sale, when a buyer can spread payments over time, increased the number of defaulted debts, and the need for debt recovery. Like banking, debt collection was a “personal” business based on house calls and letters.

As the need for debt collection grew, more companies formed. Sweden’s Intrum Group was established in 1923 and would later include Norway’s Lindorff. Kredinor, also from Norway, came in 1905. In France and Germany, independent debt collection entities surfaced in the 1920s. The first industry associations were formed, in France (1925) and Norway (1929).

Credit cards amplify needs

After World War II, credit lending to consumers rose to new heights. Credit historians often point to the arrival of the credit card as a pivotal step. It brought about a democratization by making credit accessible to more people, not just the affluent. Credit cards became commonplace in the USA in the 1960s, and were by the 1990s widespread in Europe.

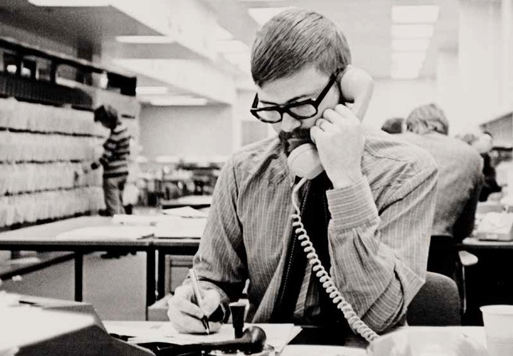

With more credit in the system, collection cases also increased. For volume reasons, debt collection now had to be done more remotely, a development aided by technological advancements. House calls were replaced with letters, that became more standardised and less personal. The telephone started being used for long-distance collections in Europe in the 1960s, after being employed in the US in the 1940s.

The US debt collection industry also adopted automation early on. There is evidence that IBM machines were used to assist the debt recovery processes in the 1960s. Computerisation of debt collection came to Europe in the 1980s.

Also, debt collectors began avoiding legal proceedings, especially when the due amount was low.

The European market expands

In the late 1900s, debt collection became a multinational business. The fall of communism in 1989 opened the Eastern European markets to credit products – and debt collection agencies. A growing European Union enabled agencies to consolidate across borders.

Today, Intrum is present in 20 European countries. The German group EOS covers 22 European countries, the Polish Kruk has a presence in 7, and the Dutch Bierens Incasso Advocaten in ten.

By the late 1900s, collectors’ business models also grew. Until then, they had helped lenders who wanted to collect on a debt by working on their behalf. Now, they could also buy the debt from the lender, becoming the creditor themselves, with the intention of either pursuing the accounts or using other collection agencies in turn.

Digitalisation and data collection

In recent years, digitalisation has made the debt collection market even more global and uniform. Multinational credit management companies have developed debt collection methods based on gathering and interpreting large amounts of data.

Technology helps to better meet clients’ demands, provide a higher level of availability to the customers, as well as ensure that customers are approached with regard to their individual needs. Risk associated with such technologies are constantly addressed, so that the automated processes are not biased or discriminatory, and that the data subjects’ rights and the principles of data protection are covered.

The European General Data Protection Regulation (GDPR), which was introduced in 2016, strengthened end users’ rights in how their personal data was handled, helping in turn also to enhance trust in the credit management industry. However, the interpretation of GDPR rules still varies among different countries.

Technology has helped to better meet both client demands and customer needs - and their integrity.

Developing rules and regulations

Over the years, clearer ethical guidelines and EU regulation have benefited both customers and companies in the credit management industry, and helped counter misconduct. In 2015, Intrum formulated its first “client selection policy” to ensure that agreements were made only with reputable clients. Later, the company introduced principles for treating customers fairly, which encompass aspects such as confidentiality, conflicts of interest, and methods of contact.

Such frameworks often go beyond what is prescribed by national debt collection legislations, which otherwise exists in several, but not all, European countries.

The Swedish Debt Collection Act was introduced in 1974, followed by similar acts in Norway (1988), Denmark (1997), and Finland (1999).

Differences in legal traditions among European countries complicates ambitions of uniform debt collection legislation in Europe. However, at the end of 2021, the EU approved the Directive on NPLs (Non-Performing Loans). This directive addresses the parts of the debt collection market that collaborate with banks and is set to be implemented in EU member states by the end of 2023. However, it does not cover other client categories than banks and lacks precision regarding consumer protection. A broader harmonisation of laws for debt collection operations is expected to take place at the earliest in five to ten years, by Intrum’s estimates.

Some European countries have also put in place licensing requirements for debt collection, particularly for working with banks. Other regulatory instruments focus on promoting certain practices and standard agreements. In some countries, consumer organisations are active actors, and social media is a widely used channel for end customers to raise awareness of misconduct by nonprofessional debt collection companies.

A sustainable credit management world

New working methods have had a tremendous impact on the industry. An in creased awareness of debtor psychology and an increased focus on sustainability has led to a more nuanced training of debt collectors’ personnel. Treating customers fairly is the cornerstone of reputable debt collection companies, as well as empathy, ethics, responsibility, and a focus on finding constructive solutions. And while digital solutions simplify work, the companies in the industry still employ thousands of personal advisors, who on a daily basis seek to understand and provide guidance for their customers.

The debt collection industry continues to be intertwined with financial and credit markets. It is today a credit management industry, much larger than its debt management origins. At its core, however, it still provides the same function as always to the world economy. Debt collectors secure functioning payment flows for companies, while helping customers pay off their debts and assisting them in gaining better financial standing. Some describe it as “being the grease in the economy” – which we explore more in another article.